Overview

California FAIR Plan Lawsuit: Delayed or Denied Fire Damage Claims

If you’re a California FAIR Plan recipient who is facing delays or denials on a smoke, ash, or fire damage claim for your home, you may be eligible for compensation. Singleton Schreiber is here to help you understand what the FAIR Plan should cover and ensure you receive the full benefits available under your policy in a fair and timely manner.

Are You Eligible?

If you or a loved one has experienced any of the following, contact us today for a free case evaluation:

- You are insured through the California FAIR Plan; and

- You filed a claim and experienced:

- Delayed claim handling (unreasonable wait times, stalled adjuster activity, repeated “we’re reviewing” responses)

- Denied coverage for some or all losses

- Low or partial payments that don’t reflect the true cost to clean, remediate, or repair

- Disputes over scope (what’s damaged, what needs replacement, what’s “cleanable”)

The California FAIR Plan Explained

The California FAIR Plan was established to ensure that property owners who are unable to obtain coverage in the traditional insurance market, through no fault of their own, can still access basic property and fire insurance.

As a state-mandated program operated by property insurance companies doing business in California, the FAIR Plan serves as an “insurer of last resort” for many homeowners in higher-risk wildfire areas, including those who have experienced nonrenewal or when insurers decline to issue a new policy.

When The System Breaks Down

Because the FAIR Plan is often the only option for homeowners who cannot secure traditional coverage, policyholders may have limited alternatives when claims are delayed or denied. Homeowners can be left without the timely benefits they need to remediate smoke and ash damage, begin repairs, and stabilize their housing situation.

That’s why Singleton Schreiber is advocating for policyholders and intends to challenge any improper claim handling, including unreasonable delays, wrongful denials, and other practices that may unlawfully limit or postpone access to benefits.

Recent Legal Action Taken Against FAIR Plan

Smoke and ash damage isn’t always visible, but it can be costly and dangerous. A California judge recently ruled that FAIR Plan’s smoke-damage standard was unlawful because it imposed extra hurdles that narrowed coverage below what California’s standard fire policy requires. Specifically, the FAIR Plan had conditioned smoke coverage on “permanent physical damage” and often required smoke impacts to be visible or detectable by smell.

California Insurance Commissioner Ricardo Lara has publicly pushed back on smoke-claim denials and limitations. Taking legal action in July 2025, his alleged violations include misrepresenting policy terms, failing to investigate claims fairly, and denying legitimate claims without reasonable basis.

Even so, insurers may still resist paying for the full scope of work needed to address smoke and ash impacts, including:

- Full-home cleaning and remediation

- HVAC inspection, cleaning, or replacement

- Insulation replacement

- Odor remediation

- Replacement of porous materials (drywall, textiles, cabinetry, soft goods)

If you’re being told the damage is “minor,” “cleanable,” or “not covered,” it may be worth getting a free case evaluation.

Our Team

With the largest fire litigation practice in the country, Singleton Schreiber has represented 30,000+ wildfire victims and recovered more than $3 billion for clients nationwide. Our attorneys help individuals and families recover after wildfires, whether by holding negligent parties accountable for starting the fires, navigating disaster relief programs, or guiding clients through the insurance claims process, including the FAIR Plan.

If you’re facing delays, denials, or any other issues with your FAIR Plan insurance, contact us today.

News & Insights

Blog Posts

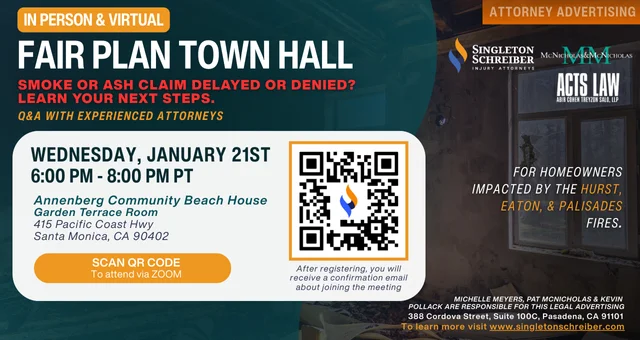

Events

Join The Lawsuit

Please fill out the form below.